The stock market, which is frequently seen as a complex financial domain, can be simplified by comparing it to a simple concept: a cake. Using the analogy of a cake, we’ll delve into the stock market, its inner workings in this blog. Understanding the elements influencing stock prices, much as the taste of a cake influences demand and prices, can make navigating the stock market a piece of cake.

What is the Stock Market?

The stock market is a dynamic financial marketplace where individuals and institutions come together to buy and sell ownership shares in publicly-traded companies. These ownership shares are represented as stocks or shares of a company’s equity. Upon purchasing a stock, you become a shareholder, thereby acquiring a portion of that company. The stock market serves as a crucial mechanism for companies to raise capital by selling shares to the public and for investors to potentially grow their wealth through the appreciation of stock prices.

Understanding the Stock Market

Understanding the stock market is essential for both seasoned investors and newcomers. It’s a place where the performance of a company, investor sentiment, and economic factors converge to determine stock prices. Various factors, such as company earnings, economic data, geopolitical events, and investor psychology, can influence the stock market. Successful stock market participation requires a combination of research, analysis, and a long-term perspective.

How Does the Stock Market Work?

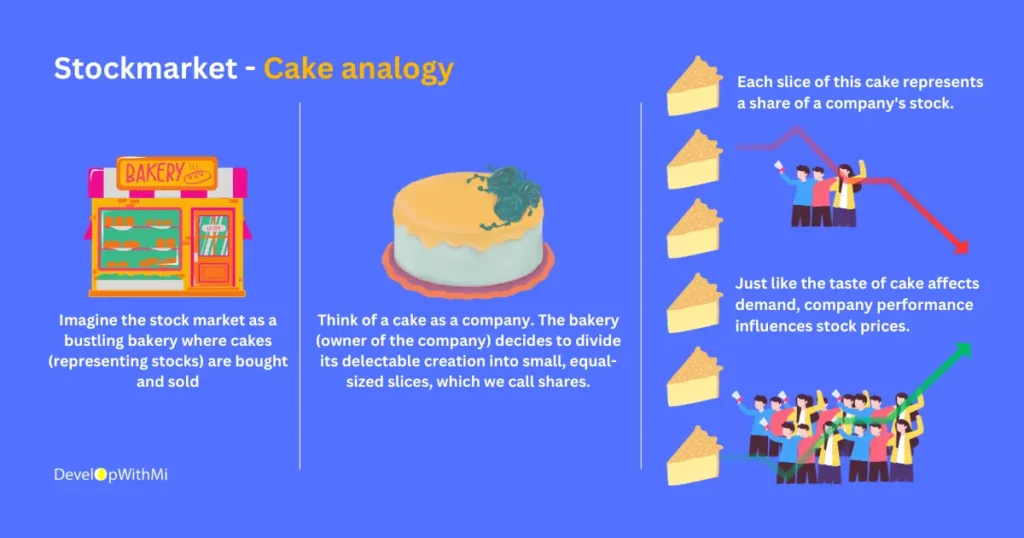

Imagine the stock market as a bustling bakery where cakes (representing stocks) are bought and sold. Here’s how it all comes together:

- The Cake (Company): Think of a cake as a company. The bakery (owner of the company) decides to divide its delectable creation into small, equal-sized slices, which we call shares.

- The Cake Slices (Stocks): These cake slices represent the shares of the owner ownership. Each slice has a value, and the owner initially sets the price for each slice, say ₹300.

- The Taste Test (Company Performance): Just as the taste of the cake determines its demand, the performance of the company influences stock demand. If the company is doing well, earning profits, and growing, it’s like having a delicious cake. Investors clamor for a slice, and the stock price can rise, say, to ₹450. Conversely, if the company faces challenges or poor performance, it’s like a cake that doesn’t taste quite as good. Demand wanes, and the stock price may fall to ₹250.

- Marketplaces (Stock Exchanges): Our bustling bakery operates in a marketplace, and in the real world, these marketplaces are stock exchanges like the New York Stock Exchange (NYSE), Nasdaq, and in India, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). These exchanges facilitate the buying and selling of cake slices (stocks) and ensure transparency and fairness.

- Profits and Losses: Just as you can make a profit by selling slices of a delicious cake at a higher price, owning stocks when their value rises can lead to profits. But if the cake (company) doesn’t taste great, you might sell slices at a lower price, resulting in losses.

What Are Stock Exchanges?

Stock exchanges are organized marketplaces where stocks, bonds, and other financial instruments are bought and sold. These exchanges provide a platform for companies to list their shares for public trading and for investors to trade these securities efficiently. Major stock exchanges like the NYSE, Nasdaq, BSE, and NSE play a pivotal role in shaping the global financial landscape, offering a wide array of investment opportunities.

How Are Stock Markets Regulated?

Stock markets are regulated to ensure fairness, transparency, and investor protection. Regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC) in the United States and the Securities and Exchange Board of India (SEBI) in India, oversee market activities. They establish rules, monitor compliance, and investigate fraudulent practices to maintain market integrity and safeguard investor interests.

How to Start Trading on the Stock Market

- Education: Begin by learning about the stock market, investment strategies, and risk management through books, courses, or online resources.

- Select a Brokerage: Choose a reputable brokerage platform to open an account. Ensure it provides the tools and research resources you need.

- Fund Your Account: Deposit funds into your brokerage account to start trading.

- Research and Analysis: Conduct thorough research on companies and industries you’re interested in. Use financial statements, news, and expert analysis.

- Practice with a Demo Account: Some brokerages offer demo accounts where you can practice trading without real money.

- Start Small: Begin with a diversified portfolio and invest only what you can afford to lose.

- Monitor and Learn: Continuously track your investments, stay informed about market developments, and learn from your experiences to refine your trading strategy

Conclusion

The stock market is a dynamic and varied environment that, with the right knowledge and strategy, can be understood and managed. While it is has its risks and uncertainties, it also provides numerous potential for wealth development and financial progress.

Success in the stock market, like any other effort, demands careful planning, continual learning, and the ability to adapt to changing circumstances. Patient, diversified, and well-informed investors can reap the benefits of possible capital gains, dividends, and long-term financial security.

The stock market, like any culinary adventure, has its ups and downs, but it also promises a rich future. Individuals can benefit from it by handling it with caution and a well-defined investment strategy.